Choosing the Right Mortgage Lender in Omaha to Fit Your Budget

Wiki Article

Find the Perfect Home Loan Broker for Your Home Mortgage Needs

Choosing the best home mortgage broker is a crucial action in the home finance process, as the expertise and resources they offer can substantially impact your monetary result. It is vital to consider different variables, including their sector experience, accessibility to a variety of lenders, and the clarity of their communication. Furthermore, recognizing their fee structure and services can help you make an informed decision. However, understanding where to start in this search can frequently be frustrating, raising the question of what particular high qualities and credentials genuinely established a broker apart in an open market.Recognizing Mortgage Brokers

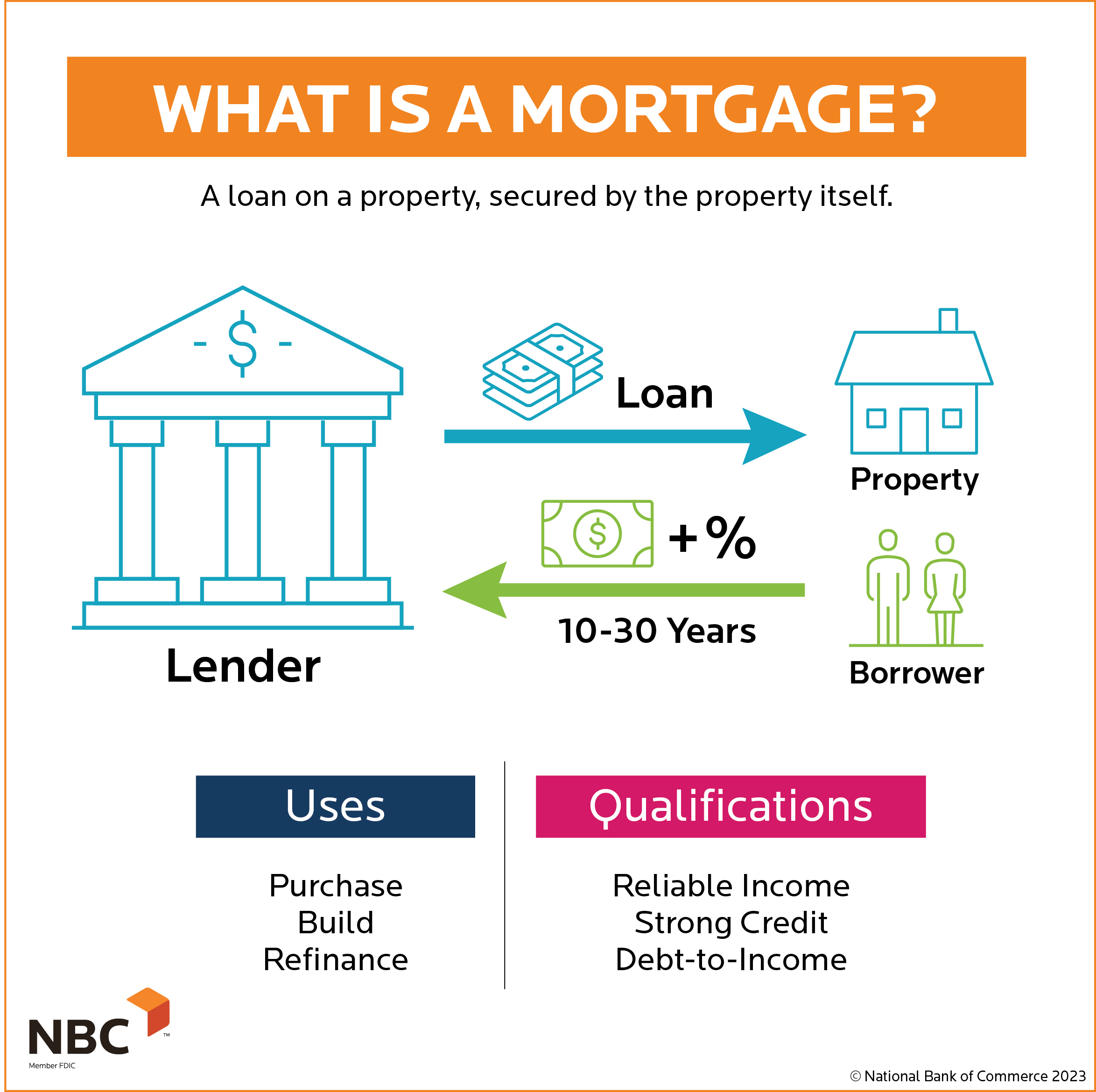

Recognizing home mortgage brokers is crucial for navigating the intricacies of home funding. Mortgage brokers work as middlemans between borrowers and lending institutions, assisting in the process of safeguarding a home loan. They have considerable expertise of the borrowing landscape and are proficient at matching customers with suitable finance items based on their financial profiles.A crucial feature of home mortgage brokers is to evaluate a customer's monetary circumstance, including credit report, revenue, and debt-to-income proportions. This evaluation allows them to recommend mortgage choices that align with the customer's requirements and capacities. Furthermore, brokers have accessibility to a selection of lenders, which allows them to present several lending options, possibly resulting in much more favorable terms and prices.

Additionally, home loan brokers improve the application process by assisting with the necessary documents and interaction with the lender. Their knowledge can likewise confirm very useful in browsing regulative requirements and industry adjustments. By utilizing a mortgage broker, debtors can save time and minimize tension, making certain a more enlightened and effective home financing experience. Recognizing the function and benefits of home loan brokers eventually equips homebuyers to make informed decisions throughout their mortgage trip.

Trick Top Qualities to Seek

When selecting a mortgage broker, there are several key qualities that can considerably affect your home financing experience. Firstly, try to find a broker with a solid track record and favorable client reviews. A broker with completely satisfied customers is most likely to offer trustworthy service and sound guidance.A broker with substantial market knowledge will certainly be better equipped to browse complex home mortgage choices and provide customized services. A broker that can clearly explain terms and procedures will certainly ensure you are educated throughout your mortgage trip.

Another crucial high quality is transparency. A credible broker will honestly review fees, possible conflicts of passion, and the entire loaning process, enabling you to make enlightened decisions. Seek a broker who demonstrates solid negotiation abilities, as they can safeguard much better terms and prices in your place.

Finally, consider their schedule and responsiveness. A broker who prioritizes your requirements and is conveniently available will certainly make your experience smoother and much less stressful. By examining these vital high qualities, you will be much better positioned to find a home mortgage broker that aligns with your home mortgage needs.

Inquiries to Ask Possible Brokers

Picking the right mortgage broker involves not only identifying key qualities but additionally involving them with the appropriate inquiries to determine their proficiency and fit for your demands. Begin by asking concerning their experience in the sector and the kinds of financings they concentrate on. If they straighten with your certain monetary situation and goals., this will certainly assist you comprehend.

Inquire regarding their process for assessing your economic health and wellness and figuring out the finest mortgage alternatives. This concern reveals just how complete they are in their approach. In addition, ask regarding the variety of lenders they deal with; a broker who has accessibility to several lenders can offer you extra competitive prices and options.

You ought to additionally discuss their charge framework. Comprehending just how they are compensated-- whether with ahead go to these guys of time fees or compensations-- will certainly give you insight into possible conflicts of rate of interest. Ask for referrals or testimonials from previous clients. This can supply beneficial information regarding their integrity and consumer service. By asking these targeted questions, you can make a much more enlightened choice and find a broker who finest fits your home lending requirements.

Researching Broker Credentials

Thoroughly looking into broker qualifications is an important step in the home mortgage option process. Ensuring that a home mortgage broker possesses the appropriate credentials and licenses can substantially impact your home loan experience.Additionally, discovering the broker's experience can give insight into their experience. A broker with a tested track document in successfully shutting lendings similar to your own is important.

Moreover, investigate any type of corrective actions or issues lodged against the broker. On the internet testimonials and reviews can use a glance into the experiences of past customers, aiding you assess the broker's credibility. Inevitably, thorough research into broker credentials will certainly encourage you to make an educated decision, fostering confidence this hyperlink in your home loan procedure and boosting your total home buying experience.

Examining Charges and Solutions

Reviewing costs and services is typically a vital component of picking the ideal mortgage broker. Openness in charge structures permits you to compare brokers properly and examine the overall price of acquiring a mortgage.In enhancement to fees, take into consideration the series of solutions provided by each broker. Some brokers give a detailed suite of services, consisting of monetary consultation, help with paperwork, and recurring support throughout the financing process. Others might focus only on helping with the loan itself. Examining the quality of solution is just as essential as it straight impacts your finance experience - Mortgage Loans.

When reviewing a broker, ask about their accessibility, readiness, and responsiveness to address questions. A broker who focuses on customer support can make a substantial distinction in browsing the intricacies of home mortgage applications. Inevitably, recognizing both solutions and charges will certainly equip you to choose a home mortgage broker that straightens with your economic demands and assumptions, making sure a smooth course to homeownership.

Verdict

To conclude, picking a proper home mortgage broker is crucial for achieving favorable finance terms and a structured application procedure. By prioritizing brokers with strong credibilities, considerable experience, and access to numerous lending institutions, people can boost their opportunities of securing affordable prices. In addition, reviewing interaction skills, cost frameworks, and general transparency will certainly add to an extra educated decision. Inevitably, a trustworthy and knowledgeable home mortgage broker functions as a beneficial ally in browsing the complexities of the mortgage landscape.Choosing the best mortgage broker is a crucial step in the home financing process, as the expertise and resources they give can substantially influence your economic result. Home mortgage brokers serve as middlemans between lending institutions and customers, promoting the process of securing a home loan. Recognizing the role and advantages of home loan brokers eventually encourages homebuyers to make enlightened decisions throughout their home mortgage journey.

Guaranteeing that a home mortgage broker possesses the ideal qualifications and licenses can considerably affect your home funding experience. Ultimately, a knowledgeable and credible home mortgage broker serves as a useful ally in navigating the intricacies of official site the mortgage landscape.

Report this wiki page